Looking for the top banks in Abu Dhabi? You’ve found the right place! In this post, we compile a list of the finest Abu Dhabi banks in terms of the quality of the financial services they provide to their customers.

One of the first things you should do when relocating to a new place is to open a bank account. This list of the best banks in Abu Dhabi might be helpful if you are a new resident of the capital city or are considering moving there.

Top Banks in Abu Dhabi

Here’s a rundown of some of the top Abu Dhabi banks to consider using if you’re about to set up permanent residence there. Article

Abu Dhabi Islamic Bank (ADIB)

Abu Dhabi Islamic Bank (ADIB) is well regarded among Abu Dhabi banking institutions. They have banking services available by phone, cell phone, SMS, and the internet.

Features of the Abu Dhabi Islamic Bank

Their professional bank employees can assist you in creating a savings and investment strategy unique to your needs and goals.

Customers of this Abu Dhabi bank may use the ADIB app to do various financial tasks, including making transfers and payments, while on the go.

Aside from banking work, you should do some other things while you are in Abu Dhabi. If you want to drive a car or rent a car in Abu Dhabi, you should have a driving license. So go through a guide to getting a driving license in Abu Dhabi.

Address: 100 Knightsbridge, London SW1X 7LJ, United Kingdom

Abu Dhabi Commercial Bank (ADCB)

The Abu Dhabi Commercial Bank, or ADCB for short, is our next pick for the finest bank in Abu Dhabi. Popularity surged as it introduced a swift and easy banking experience and a variety of valuable rewards programs.

One of the most popular perks of having an ADCB credit card is getting two tickets to a movie at VOX Cinema for the price of one. If you’re searching for a fantastic bank in Abu Dhabi with competitive mortgage rates, ADCB is a great option.

Features of the Abu Dhabi Commercial Bank

Additionally, this Abu Dhabi bank merged with Union National Bank (UNB) and Al Hilal Bank to become the third-largest bank in the United Arab Emirates.

The worldwide banking network known as Standard Chartered is a perfect bank in Abu Dhabi. Everything from savings accounts to mortgages to credit cards to retirement plans to insurance is available.

The online banking facility they provide is likewise regarded as among the best in Abu Dhabi. The bank is a global institution with a headquarters in Abu Dhabi, although it provides Islamic banking services to UAE nationals only.

Address: Sheikh Zayed Road Mall of Emirates Ground level Entrance # 1 – Dubai – United Arab Emirates

First Abu Dhabi Bank (FAB)

Following the merger of First Gulf Bank and the National Bank of Abu Dhabi, this institution began operations on April 17th, 2017. It is the largest financial institution in Abu Dhabi and the rest of the United Arab Emirates.

As the top bank in Abu Dhabi, FAB is renowned for its superior service and satisfied clients. The company is headquartered in Abu Dhabi’s Khalifa Business Park.

Moreover, FAB has locations in a variety of countries:

- Africa

- America

- Asia-Pacific

- Middle-East

- Middle-East Europe

Features of the First Abu Dhabi Bank

FAB is 33.3% owned by the Abu Dhabi Investment Council Company. The first overseas FAB location opened in Saudi Arabia in 2019, and the company has been steadily expanding its reach since then.

Not only is FAB the most reputable financial institution in the United Arab Emirates, but it is also widely regarded as the most secure financial institution in the whole Middle East.

This bank requires a physical visit to Abu Dhabi in order to create an account. While visiting the bank, we suggest you see Abu Dhabi Al Hudayriat Island. This island is so beautiful and eye-catching. Also, an Abu Dhabi Al Hudayriat Island guide will help you tour the area thoroughly.

Address: QWQX+VQ2 – Sheikh Mohammed Al Qassimi Street – Al Khor Rd – Ras al Khaimah – United Arab Emirates

First Gulf Bank: A bank with branches in different countries

The Abu Dhabi-based First Gulf Bank was founded in 1979. The bank’s main divisions are the Wholesale Banking Group, Treasury and Global Markets, Consumer Banking, Real Estate, and Other Operations.

Features of the First Gulf Ban

About 1,400 people are employed by the company, which has locations in Kuwait, China, the United Kingdom, France, Malaysia, Bahrain, Sudan, Hong Kong, Switzerland, Lebanon, Labuan, Oman, Egypt, the United States of America, Jordan, Brazil, and India.

The bank had a net profit of $1.65 billion in 2016, while its total assets were $66 billion in the same year.

Address: 937 Zayed The First St – Zone 1 – Abu Dhabi – United Arab Emirates

Mashreq Bank in Abu Dhabi

Founded in November 1975, the Arab Bank for Investment & Foreign Trade (Al Masraf) began its banking activities in 1976 following Federal Decree No. 50, issued and signed by His Highness Sheikh Zayed Bin Sultan Al Nahyan.

His Highness Sheikh Zayed Bin Sultan Al Nahyan and the other rulers of the Emirates put their foresight, knowledge, and vision into action with the construction of Al Masraf. The Bank was established to foster cooperation among Arab nations and encourage their participation in cooperative economic initiatives.

Features of the Mashreq Bank in Abu Dhabi

Al Masraf’s three largest shareholders are the UAE’s Emirates Investment Authority (42.28%), Libya’s Libyan Foreign Bank (42.28%), and Algeria’s La Banque Exterieure d’Algerie (15.44%).

To achieve its dynamic purpose and vision and develop into an original and trusted financial partner for all banking services, they are aggressively pursuing a comprehensive modernization strategy at all levels of the business.

They now provide a comprehensive suite of banking, corporate banking, Islamic banking, and treasury and investment services to assist their clients in establishing and maintaining stable financial foundations.

They believe it is important to adapt to the changing demands of their customers, and therefore they work hard to ensure that all of their offerings are as cutting-edge as possible.

Address: Blue Tower, Ground Floor – 3rd St – Abu Dhabi – United Arab Emirates

Al Hilal: A bank in Abu Dhabi with secure digital payment options

This bank opened its doors in Abu Dhabi on June 19, 2008, and the city is home to its primary offices. The ADCB official group oversees it. However, it functions apart from the ADCB budget to fulfill its stated goals.

Features of the Al Hilal bank in Abu Dhabi

In addition to traditional banking services, Al Hilal Bank now provides convenient and secure digital payment options for a wide range of devices and operating systems. A safe and confidential method of communication is also provided.

You can trust them with your banking work, such as opening a new account. They also open accounts for foreigners. However, if you have some other work in Abu Dhabi related to your passport, you should follow some other procedures.

For example, if you are a Filipino, you need to go through Philippine passport renewal in Dubai and Abu Dhabi. But before that, you should know how to renew your Philippians passport in the UAE. It’s better to do it immediately so you don’t face any problems with your account.

Address: FC42+H7Q – Al bahar Tower, Al Salam Street, Markaziyah, near Abu Dhabi College – Abu Dhabi – United Arab Emirates

Axis Bank: The Best Indian Private Bank in Abu Dhabi

The Axis Bank Group is the third biggest private bank in India. Large and medium-sized businesses, micro, small, and intermediate enterprises, as well as agricultural and retail enterprises (REs) can all use the full range of banking services provided by this institution.

As of March 31, 2020, the bank’s extensive network includes 12,044 (ATMs) and 5,433 cash recyclers, in addition to its 4,528 domestic branches (including extension counters).

Features of the Axis Bank

The bank’s activities abroad are dispersed among twelve different countries. These countries include Singapore, Hong Kong, Dubai (at the DIFC), Colombo, Shanghai, and Gift City-IBU, with representative offices in Dhaka, Dubai, Abu Dhabi, and Sharjah. Also, it has a wholly owned overseas subsidiary in London, United Kingdom.

Corporate financing, trade finance, syndication, investment banking, and liability enterprises are the main focuses of international offices.

Axis Bank’s online banking services are comprehensive and designed to make account management easier for customers. Axis Bank is committed to making high-quality banking convenient for you. With Axis Bank’s online banking, you can take care of most banking transactions whenever it’s most convenient for you.

Address: Al Masaood Tower 1003 10th Floor – Hamdan Bin Mohammed St – near Crowne Plaza – Abu Dhabi – United Arab Emirates

Bank of Baroda Abu Dhabi

It has been a lengthy and dramatic voyage that has taken place in 17 different nations and almost a century. Today’s story of how the company went from a modest structure in Baroda in 1908 to the state-of-the-art Baroda Corporate Centre in Mumbai is an inspiring tale of foresight, initiative, fiscal responsibility, and sound corporate management.

The bank has started a business transformation program that will affect all aspects of the company, including its employees, procedures, and final goods. They picked the bold, one-color vermillion palette because of its ability to convey optimism and vitality while standing out from the crowd.

Features of Bank of Baroda Abu Dhabi

Another thing that defines the bank is its inclusive culture. They have locations worldwide, in both urban and rural areas. Their clients represent a diverse range of businesses and professions.

The Baroda Sun is an appropriate representation of the company’s identity since it is a globally recognized sign of vitality. They hope that the bank resonates with all of their target demographics.

It’s not just a facelift; they have a whole new company brand identity. It indicates that they understand the need to adapt to the changing business landscape in today’s interconnected globe.

On the other hand, they will never lose sight of the roots from which the bank sprang or the dependable partnerships that have sustained them over the years. They seek to convey both simplicity and strength by using the Baroda Sun as their emblem.

Address: Ground floor, Al Jazeera Towers – Hamdan Bin Mohammed St – Zone 1 – E8 – Abu Dhabi – United Arab Emirates

BMCE bank: A famous international bank in Abu Dhabi

Formerly known as the Moroccan Bank of Foreign Commerce (BMCE Bank), the Bank of Africa is now one of Morocco’s largest commercial banks. The organization has over 697 locations in Morocco and over 560 locations throughout the rest of Africa, as stated on its website.

The Bank of Africa operates branches in several countries throughout the world. These countries include Europe, Asia, France, Spain, the United Kingdom, China, Italy, Germany, the United Arab Emirates, Belgium, Canada, and the Netherlands.

Features of BMCE Bank in Abu Dhabi

The bank’s shares are traded on the Bourse de Casablanca, often known as the Casablanca Stock Exchange.

Finding a reliable bank is essential, whether you want to open a checking or savings account, get a loan or line of credit, or maintain any other kind of financial relationship. Choose a bank that fits your needs to keep your money under control.

BMCE Bank is a service provider in the Abu Dhabi market. Professionals here can help with things like transferring money, opening bank accounts, and more. Also, consumers rated this establishment 4.80 out of 5 on Nice Local.

Additionally, they welcome non-citizens by opening bank accounts for them. But if you need to do any passport-related tasks in Abu Dhabi, there are other steps you’ll need to take. If you are a Pakistani citizen and need to renew your passport, you may do it in Dubai or Abu Dhabi. But before that, you need to know how to renew a Pakistani passport online in Dubai and Abu Dhabi. It’s advisable to do it promptly so you don’t experience any difficulties with your account.

Address: 733 Hazza ‘ Bin Zayed The First St – Zone 1 – E18-01 – Abu Dhabi – United Arab Emirates.

CBI bank: Reliable banking services in Abu Dhabi

Since its founding in 1991, CBI has been a trusted partner to successful businesses and individuals in the United Arab Emirates (UAE) by providing reliable banking services. Their solid financial footing and the investment grade rating they’ve received from Fitch, a respected international rating organization, are the foundations on which this assurance rests.

They place their faith in the people of the UAE and want to serve them by contributing to their economic and personal success, all in the name of furthering the UAE’s goal.

Features of CBI bank in Abu Dhabi

Of course, they’ll keep spending money on cutting-edge innovation, but they know that getting to know their consumers on a more personal level is the key to keeping them as clients for the long run.

CBI has its main office in Dubai, was founded in Ras Al Khaimah, and is traded on the Abu Dhabi Securities Exchange. CBI is regulated by the UAE Central Bank and the UAE Securities and Commodities Authority (SCA).

The company is majority owned by UAE shareholders, including the government of Ras Al Khaimah. Also, the Board of Directors is also led by Saif Ali Al Shehhi, a UAE national.

Address: F89Q+584 – Sheikha Fatima Park – Al Bateen – W12 – Abu Dhabi – United Arab Emirates.

The Central Bank of the UAE branch in Abu Dhabi

The United Arab Emirates currency, monetary policy, and banking regulation are all managed by the Central Bank of the United Arab Emirates (commonly known as the CBUAE), a governmental agency.

The central bank’s predecessor, the Currency Board, was founded on May 19, 1973. It was a natural progression from 1971, when the United Arab Emirates (UAE) became a sovereign nation.

The United Arab Emirates Currency Board was established to create a new national currency to replace the Qatari riyal and the Bahraini dinar. When the Currency Board of the United Arab Emirates was founded, a new dirham was also introduced.

Features of the Central Bank of the UAE

The Currency Board of the United Arab Emirates lacked complete central bank authority at the time. It was tasked with handling the UAE’s currency and the country’s gold and exchange program reserves but could not set or implement monetary policy.

The Central Bank of the United Arab Emirates (UAE) was founded as a government agency in 1980 by Union Law No. (10). The Central Bank’s powers (formerly handled by the Currency Board) were expanded by Law No. (10), with Abdul Malik Yousef Al Hamar named Governor.

The bank has five more locations in the United Arab Emirates and its headquarters in Abu Dhabi. The following are the locations:

- Dubai

- Al Ain

- Fujairah

- Ras Al Khaimah

- Sharjah

Address: F84P+MWQ – next to King Abdullah Bin Abdulaziz Al Saud Street – Al Bateen – W34 – Abu Dhabi – United Arab Emirates

NBQ Abu Dhabi: National bank in Abu Dhabi

A financial institution founded in the United Arab Emirates, the National Bank of Umm Al Qaiwain PSC (NBQ) offers retail and corporate banking services through a nationwide network of 17 branches and 13 electronic banking services units (UAE).

Features of the NBQ Abu Dhabi

Retail and corporate banking, as well as treasury and investment services, make up the bank’s two primary lines of business.

The UAE Central Bank and other banks and financial organizations are only some of the parties involved in the foreign exchange and other Treasury and investing operations.

If you want to open an account with this bank, you need to travel to Abu Dhabi and follow the legal procedures. However, don’t forget to know all about the new Abu Dhabi travel restrictions before coming to Abu Dhabi.

Address: Hashimi Tower, Shaikh Rashid Bin Saeed Street – Abu Dhabi – United Arab Emirates

Citi bank Abu Dhabi: A bank with innovative financial solutions

The Citibank brand initially arrived in the United Arab Emirates in 1964, when the first branch of Citibank (then known as Citibank) opened in Dubai. Since then, the bank’s reputation in the UAE market has grown thanks to its commitment to providing superior service and the most innovative financial solutions.

After being granted authorization to do business by the Dubai Financial Services Authority, Citi established a regional Middle Eastern office in the DIFC in 2006.

Features of the Citi bank Abu Dhabi

The Abu Dhabi Global Market (ADGM) authorized a Citibank NA branch in 2018 in Abu Dhabi. Customers in the United Arab Emirates who are interested in establishing regional Treasury centers may now use the liquidity management solutions offered by the new Citi branch.

When it comes to consumer credit services, particularly personal loans, Citi is a leader. The United Arab Emirates is home to a number of the bank’s locations, including three physical branches, two smart centers, two Citigold lounges, and a total of 41 automated teller machines.

Citi stands out from the crowd in the investment banking industry by combining prestigious mergers and acquisitions (M&A) and capital markets expertise with a well-established regional banking presence.

Address: Al Khyeli Building – Al Falah St – Zone 1 – Abu Dhabi – United Arab Emirates

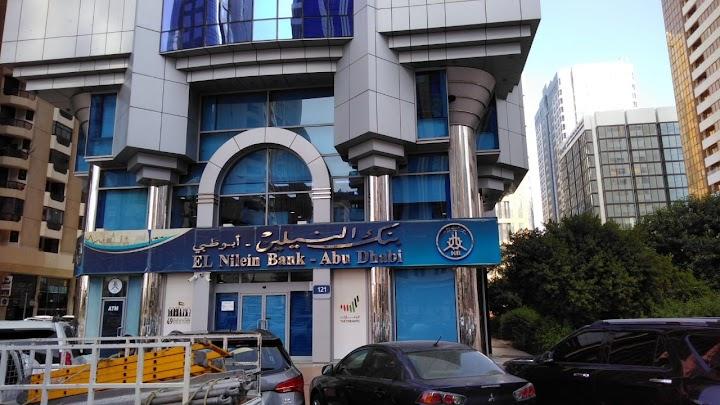

El Nilein bank in Abu Dhabi

The merger of Credit Lyonnais, the Arab Bank, and the Red Sea Bank in 1963 gave rise to El Nilein Bank. El Nilein Bank Group was established in 1970 when the bank was nationalized.

There was a merger between El Nilein Bank and the Industrial Development Bank in 1993, and the resulting institution was called the El Nilein Industrial Development Bank Group. After splitting off from the El Nilein Industrial Development Bank Group in 2007, the company is now known simply as El Nilein Bank.

As one of the earliest Sudanese banks in the United Arab Emirates, they are very proud of their role in fostering closer ties between the two countries over the last forty years.

Features of the El Nilein Bank

Al Nilein Bank’s mission is to become the preeminent Islamic financial institution in the world through a commitment to its clients, a relentless pursuit of excellence in everything that they do, and the active engagement of its brilliant staff.

Therefore, they adhere to and encourage expansion based on their prominent position inside the United Arab Emirates, which provides them with access to thriving local markets, quick expansion, and many commercial prospects.

In addition, they place a premium on their clients’ happiness. Therefore, they do their best to anticipate their requirements while navigating international marketplaces and keeping international investors interested in doing business with them.

They can sustainably lower the cost of funding thanks to the successful conversion of many fixed deposits into savings and checking accounts. This not only increases their profits and liquidity retention but also encourages the expansion of the bank’s portfolio.

Address: F9V6+6FQ – Zone 1 – E7 – Abu Dhabi – United Arab Emirates

SMBC Abu Dhabi bank

The Sumitomo Mitsui Banking Corporation (SMBC) and its affiliates provide comprehensive banking and related financial services. They operate in various credit-related markets, including leasing, securities, credit cards, investments, mortgage securitization, venture capital, and more. The following is a breakdown of the many lines of business in which SMBC and its subsidiaries and affiliates are involved.

Features of the SMBC Abu Dhabi bank

SMBC’s main office and its many branches (both domestic and international) provide a wide range of commercial banking services, such as:

- Accepting deposits

- Making loans

- Trading

- Investing in securities

- Transferring funds internationally

- Exchanging currencies

- Acting as a trustee for corporate bonds

- Roving custody services

- Underwriting

- Selling financial futures contracts,

- Selling units in investment trusts

Moreover, you can open an account at this bank to pay for your children’s school. It is very easy to open an account with this bank. Speaking of schools, we would like to introduce you to the top Indian schools in Abu Dhabi.

Address: Makeen Tower – Al Zahiyah – E16 – Abu Dhabi – United Arab Emirates

Federal Bank Abu Dhabi: Second best Indian bank in Abu Dhabi

People in both urban and rural parts of Abu Dhabi are increasingly turning to Federal Bank as their go-to for personal, NRI, and business banking needs. The bank’s primary objective is to gain recognition as a leading financial institution in the nation.

All along, their focus has been on using technology to reimagine the human condition in novel ways. The banking industry of the future may look quite different thanks to the cutting-edge digital advances of today. The Federal Bank constantly expands its motto to connect with a larger and more diverse audience.

The bank, which has been designated a Great Place to Work, is working hard to move up the ranks to become the top option for all citizens of Abu Dhabi. Their dedication to serving people both within and outside the company is the driving force behind their endeavor.

Features of the Federal Bank Abu Dhabi

Having spent the last decade primarily concerned with digital endeavors, they have laid a strong basis upon which to build their performance. In the competitive neo-banking industry, they are a go-to bank thanks to their cutting-edge digital capabilities. The bank made a decisive move to better capitalize on the new reality with the launch of digital products and digital marketing campaigns, and the result was an 86% share of digital transactions.

Their efforts to expand their secured credit portfolio, prioritize quality over quantity and keep their obligations organic and granular paid off, allowing them to make good on their capital-conservation promise. To realize their vision of being the most admired bank, they had to make some tough decisions, but they are committed to moving quickly in the right direction.

Address: 4th Floor, Hot Chilli Cafeteria Building, Near Al Falah Plaza, Al Falah Muroor Rd Junction – Abu Dhabi – United Arab Emirates

NBF bank in Abu Dhabi

The National Bank of Fujairah caters to businesses of all sizes by providing various financial services, including commercial and corporate banking, personal banking, treasury, trade finance, and Sharia-compliant banking.

Both Moody’s and Standard & Poor’s have given the bank a stable outlook of BBB+/A-2 for deposits and A3 for counterparty risk assessment. A share of NBF is denoted by the ticker symbol “NBF” on the Abu Dhabi Securities Exchange.

Features of the NBF bank in Abu Dhabi

The National Bank of Fujairah helps its customers with various financial needs, including corporate, business, personal, trade, treasury, cash flow management, valuable metals and gems, and Islamic banking.

The bank was the first conventional bank to join Nasdaq Dubai’s Islamic Murabaha platform for Islamic finance in 2017[3]. The bank’s wholly-owned subsidiary, NBF Capital Limited, also provides consulting services. NBF Direct, the bank’s online and mobile banking platform, is now available to business and individual customers.

You should visit Abu Dhabi for more than just the banking opportunities; it’s also the place to go if you want to apply for citizenship in the UAE. So before going through the process, you need to know about the step by step process on how to register for Abu Dhabi citizenship.

Address: Showroom 2, Al Sawari Tower B – Corniche Rd – Abu Dhabi – United Arab Emirates

Janata Bank Limited in Abu Dhabi

Janata Bank changed its name to Janata Bank Limited on November 15, 2007, after registering with the Joint Stock of Registrars as a public limited company.

Janata Bank has its headquarters at Janata Bhaban on Motijheel C/A in the center of Dhaka and operates a total of 915 branches around the country (including four overseas offices in the United Arab Emirates) with a large family of over 11,463 (As of 31.07.2020) workers.

Features of the NBF bank in Abu Dhabi

Janata Bank Limited is a corporate entity that has been trusted throughout the years. It is Bangladesh’s second biggest (concerning Deposits/Assets) commercial bank. Janata Bank Limited has been playing a crucial role in the entire economic operations of the nation.

It also holds a rich legacy of fulfilling admirable services to society from its foundation immediately after this green, lush alluvial soil emerged as a sovereign, independent state.

Others in this industry can’t help but desire to match the level of success JBL has achieved thanks to the bank’s contributions to the national economy and social transformation. It is also a source of great pride that the Bank has been honored with several renowned awards from both domestic and international bodies in recognition of its efforts, contributions, and successes.

Address: Obeid Sayah Al-Mansuri Building, Zayed 1st Street(Electra Street – Abu Dhabi – United Arab Emirates

HDFC bank in Abu Dhabi

The second-largest private sector bank in India, HDFC Bank, has launched a representative office in Abu Dhabi to better serve the needs of the sizable diaspora of Indians living in the United Arab Emirates.

Features of the HDFC bank in Abu Dhabi

This branch, like the Dubai office, is a representative office for the bank. The Wholesale Offshore Branch of HDFC Bank is located in the Kingdom of Bahrain and caters to corporations and high-net-worth individuals by providing them with corporate, trade financing, and consulting services.

Thanks to the new regional office’s assistance in setting up NRE accounts in the country, NRIs in Abu Dhabi can use remittance services, fixed deposit options, and other banking services connected to their India accounts. HDFC Bank has NRI remittance partnerships with exchange houses in all Gulf Cooperation Council (GCC) nations.

You must visit Abu Dhabi to open an account. In the meantime, you may opt to apply for a visa or decide to remain in Abu Dhabi permanently. In this case, you should go to medical test centers for visas in Abu Dhabi.

Address: Second Floor, Salam HQ, Office # 203, Canon Building – Sheikh Zayed Bin Sultan St – Abu Dhabi – United Arab Emirates

Emirates NBD: Third best Indian bank in Abu Dhabi

The National Bank of Dubai (NBD), the leading banking group in the MENAT region, was started in June 1963, when the late Sheikh Rashid bin Saeed Al Maktoum signed the Charter of Incorporation of the National Bank of Dubai (NBD). After that, it became the first national bank established in Dubai and the United Arab Emirates (UAE). With the blessings of H.H.

Features of the Emirates NBD in Abu Dhabi

Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, NBD merged with Emirates Bank International (EBI) on 06 March 2007 to form Emirates NBD, the largest banking group in the region by assets. On October 16, 2007, the shares of Emirates NBD were officially listed on the Dubai Financial Market (DFM).

The merger between EBI and NBD to create Emirates NBD became a regional consolidation blueprint for the banking and finance sector. In fact, it combined the second and fourth largest banks in the UAE to form a banking champion.

This champion can deliver enhanced value across corporate, retail, Islamic, investment, and private banking; global markets and Treasury; asset management and brokerage operations throughout the region.

Address: Ground Floor, Dalma Mall, Mussafah Industrial Area – Abu Dhabi – United Arab Emirates

Bank of New York in Abu Dhabi

The Bank of New York Mellon has opened a representative office in the Abu Dhabi Global Market (ADGM), a broad-based international financial center for local, regional and international institutions. The representative office will support existing and prospective clients in the region seeking access to the firm’s global capabilities.

BNY Mellon has been in Abu Dhabi since 1998 and has been conducting business in the Middle East and Africa for over 100 years. The company opened its first representative office in Lebanon in 1963 and was granted a branch license in 2008 by the Dubai Financial Services Authority.

Features of the Bank of New York in Abu Dhabi

BNY Mellon is a global investment company dedicated to helping its clients manage and service their financial assets throughout the investment lifecycle. Whether providing financial services for institutions, corporations, or individual investors, BNY Mellon delivers informed investment management and investment services in 35 countries.

As of Sept. 30, 2019, BNY Mellon had $35.8 trillion in assets under custody and/or administration and $1.9 trillion in assets under management. BNY Mellon can act as a single point of contact for clients looking to create, trade, hold, manage, service, distribute or restructure investments.

Address: F9R5+5V3 – Khalifa Bin Zayed Street (Khalifa Street) – Zone 1 – E6 – Abu Dhabi – United Arab Emirates

Conclusion on the best banks in Abu Dhabi

Those were the best banks in Abu Dhabi. You can find other banks, such as Citibank, HSBC, and Emirates NBD, with limited branches and ATMs dotted across the city. However, these banks are more popular in Dubai than in Abu Dhabi.

Apart from having some great banks, you can also find many great public hospitals in Abu Dhabi. So browse through those to get a comprehensive look at the capital city. If you are looking for a new house for sale in Abu Dhabi, there are some amazing rental apartments in Abu Dhabi. You can even find plenty of larger villas in Abu Dhabi at great prices.

On your way to finding your dream house, you can trust the best real estate company in the UAE, Al Khail company. They will help you find your dream house.